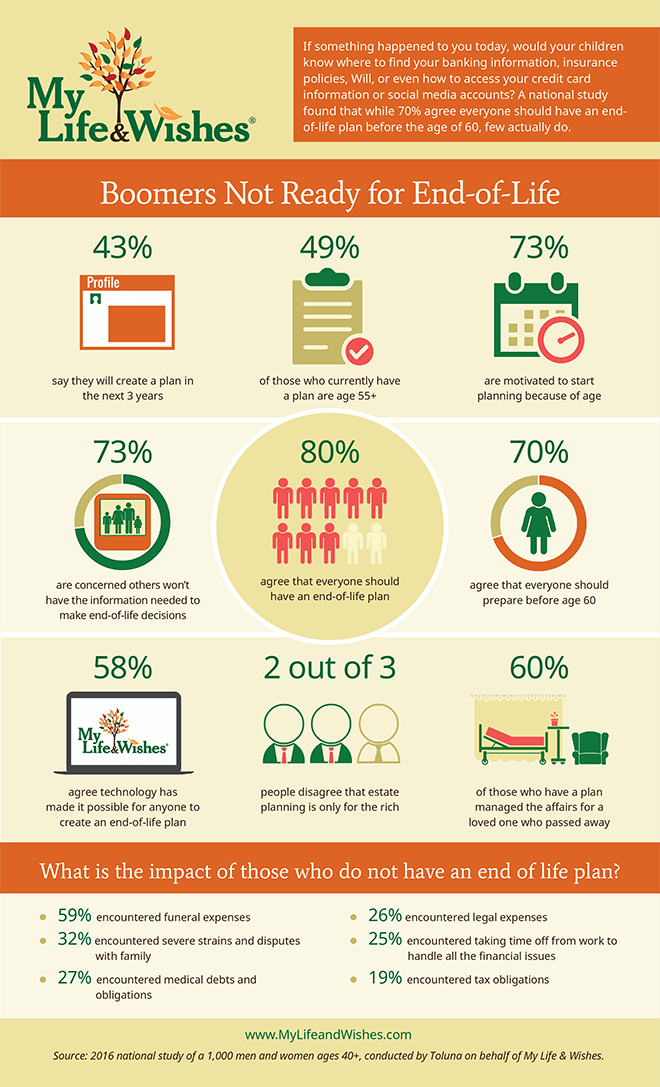

Infographic: Boomers Not Ready for End-of-Life

If something happened to you today, would your children know where to find your banking information, insurance policies, Will, or even know how to access your credit card information, smart phone, PC, on-line or social media accounts?

For most Americans, the answer is a resounding “no!” A 2017 national study of 1,000 men and women ages 40+, found that while 70% of men and women agree that everyone should have an end-of-life plan before the age of 60, few actually do.

Some of the more compelling reasons to create a plan are the toll and financial impact that families are experiencing when left to unwind their loved ones affairs without direction;

- Nearly 60% encountered funeral expenses

- 1/3 of loved ones reported disputes with family over decisions or assets

- 1/3 are left to fund medical bills and other obligations

- 1/4 had to take time off work to sort through paperwork and resolve financial affairs

Survey results also showed these numbers are poised to spike in the next 3 years as our aging nation begins to encounter the enormity of dealing with digital accounts after the death of a loved one, giving rise to a whole new industry called digital estate planning.

We live in a different world today. Technology has made things so much easier for us while we are here. But it creates a massive scavenger hunt for our loved ones after we’re gone. Many times resulting in benefits not being found, long delays in closing out our loved ones affairs, not to mention, a lot of time, money and frustration.

So don’t let your loved ones experience this, as most of it can be avoided. Create a plan and leave clear direction and instructions about your wishes, locations of needed documents and access information to everything they will need.

Let My Life and Wishes help. Download our eBook or signup for a 30 day free trial to our full on-line planing platform. Your loved ones will be glad you did!