Articles / Blogs

Accessing Technology Devices in an Emergency: What You Need to Know

Accessing Technology Devices in an Emergency: What You Need to Know

If you’re like most people today, your smartphone, tablet, or laptop is likely protected by multiple layers of security — from passcodes and fingerprint scans to facial recognition or even two-step verification.

That’s great for keeping your information safe, but it also creates a major challenge if something unexpected happens and someone else needs to access your devices.

Take my own household, for example. My spouse’s phone is protected by Face ID and a secure passcode. If something were to happen to him, I wouldn’t even know where to begin. Sure, I might have a few guesses about the passcode, but after a few failed attempts, the device would lock me out completely. And it’s not as simple as calling the phone or computer retailer — privacy regulations prevent them from unlocking or resetting a password for anyone other than the registered user.

Now, imagine what would be lost if that access were gone forever: thousands of irreplaceable photos, important correspondence, and critical digital records.

For many of us, nearly everything we need to manage our lives is stored within our technology devices. Some of the most vital information includes:

- Bill pay and subscription logins (credit cards, utilities, memberships, etc.)

- Online banking access and financial accounts

- Email and social media credentials

- Streaming and shopping accounts (such as Netflix, Apple, or Amazon)

- Contacts – both personal and professional

- Documents and contracts – business and personal

- Stored correspondence — emails, texts, messages, and records

And that’s just the beginning.

New Technology, New Barriers

Modern devices have introduced additional layers of protection that can make recovery even more difficult:

- Facial and fingerprint recognition mean access is often tied to a person’s unique biometrics — something no one else can replicate.

- Two-factor authentication (2FA) sends codes to the owner’s phone or email, which becomes impossible to access if the device is locked.

- Password managers now require their own master password or biometric verification, adding another level of separation.

- Cloud-based backups (like iCloud, Google Drive, or OneDrive) are often protected by their own credentials — and sometimes require multi-device confirmation to log in.

These are all excellent tools for privacy and security — but they can create serious complications in an emergency if no one else has the keys.

The Takeaway

While it’s reassuring to know your personal data is secure, it’s equally important to make sure someone you trust can access it if the unexpected happens. That’s where the My Life and Wishes Legacy Vault™ can make all the difference.

What makes it especially powerful is its Account Sharing feature. You can safely designate trusted individuals to have access to specific information, either immediately or only when a triggering event occurs. This ensures your loved ones or business partners have the access they need, without ever compromising your privacy or control.

Technology continues to evolve, and your emergency plan should evolve with it. Take a few minutes to ensure that the people who would need access in a crisis have a safe, legal, and secure way to obtain it.

What is the MLW Legacy Vault?

Want to learn more and see if The Legacy Vault is a fit for your practice?

Simply click the link to schedule a short demo and discussion>>

Did you know there are more than 42 million unpaid caregivers in the U.S.? That’s 42 million people stepping up to care for aging parents, spouses, or other loved ones—often while juggling work, family, and their own lives.

Did you know there are more than 42 million unpaid caregivers in the U.S.? That’s 42 million people stepping up to care for aging parents, spouses, or other loved ones—often while juggling work, family, and their own lives.

Whether you’re caregiving from a distance or providing daily support at home, it can be a rewarding yet challenging journey. If you find yourself stepping into this role, here are some practical tips to help you navigate the responsibilities:

Evaluate What You Can Realistically Do

Start by identifying what you’re best equipped to handle.

Are you great with numbers? Maybe you can manage finances and help pay bills.

Are you a planner? You might take the lead on coordinating appointments or arranging outside help.

You don’t have to do it all yourself. Build a care team by involving family, friends, neighbors, or even professionals. A sibling may be better at cooking or caregiving; a neighbor might be willing to help with errands or yard work. Delegating not only helps your loved one—it helps you stay balanced too.

Assess Your Loved One’s Living Situation

Where your loved one lives can greatly impact their quality of life—and your ability to help. Some families choose to move their loved ones into their home. Others relocate closer or coordinate care from afar.

If living together isn’t feasible, look into:

- In-home caregiving services

- Independent or assisted living communities

- Supportive technology like emergency alert systems or video monitoring

These tools can increase safety and independence, while giving you peace of mind. If your loved one is fairly independent, regular visits and check-ins can go a long way.

Add Helpful Devices and Simple Home Supports

Little changes can make a big difference when it comes to safety and independence. Technology is a wonderful ally;

- smart watches

- medical alert systems

- GPS trackers

- security cameras

- and automatic pill dispensers can all provide an extra layer of comfort and reassurance for both you and your loved one.

Just as important are the everyday items that make life easier at home;

- motion-sensor lights that brighten hallways

- grab bars and toilet seat handles that prevent falls

- or shower chairs and bed rails that add extra stability.

Even small tools like;

- a sock aide

- walker tray

- hands-free jar opener

- or electric can opener—can turn a frustrating task into something simple.

These supports may seem small, but together they can give your loved one confidence, independence, and dignity while making your caregiving role a little lighter.

Stay Connected with Technology

Technology can be a powerful tool to stay involved and informed, especially if you’re not nearby.

- Use video calls (Zoom, FaceTime, etc.) to stay in touch

- Set up a family group chat or private Facebook group to share updates

- Attend medical appointments virtually or by speakerphone

- Access patient portals (with permission) to stay up-to-date on medical care and test results

These small steps can help you stay closely connected, even from a distance.

Consider the Financial Picture

Caring for a loved one often involves financial decisions—for them and for you.

- Are there funds or insurance available to cover care services or housing?

- Can you afford to take time off work, if needed?

- How often can you travel if you’re long-distance?

Understanding your financial limits helps you make sustainable decisions. Explore benefits, community resources, or family contributions to build a support plan that works.

Find Other Ways to Stay Involved

Even if you’re not providing daily, hands-on care, there are still powerful ways to show up for your loved one;

- Send letters or care packages with their favorite snacks, books, or photos

- Schedule regular check-ins, either in person or by phone/video

- Share memories or record family stories to preserve your history together

- Celebrate milestones and holidays to keep joy and connection alive

These gestures make a big impact on emotional well-being—for both you and your loved one.

Final Thought

You don’t need to do everything, and you don’t need to do it alone. Being a caregiver is about presence, not perfection. Start with what’s possible, ask for help, and build a plan that supports both your loved one—and you.

Wrapping Up the “Click Here” Blog Series

Wrapping Up the “Click Here” Blog Series

We’ve spent the last several posts diving into a topic many of us avoid — end-of-life planning. The truth is, planning ahead isn’t about death, it’s about making life easier for the people we love.

This series was inspired by Jon Braddock’s book – Click Here When I Die – which takes a thoughtful, practical look at modern “death etiquette” in today’s digital age.

In the Click Here series, we explored everything from organizing important documents (no more “scavenger hunts” for paperwork!) to having tough but meaningful conversations with family, preparing the right legal documents, and even making a plan for your digital life. We also touched on acceptance, leaving a legacy, and shared resources to make the whole process less overwhelming.

The big takeaway? Planning ahead gives your loved ones the gift of clarity and peace of mind. It doesn’t have to be done all at once — start small, pick one step, and build from there.

👉 Want to dive deeper? Grab a copy of Click Here When I Die here: https://www.mylifeandwishes.com/checklists/

📌 Missed some of the earlier posts? Just scroll back through the blogs to catch up — each one is packed with practical tips you can start using today.

Because in the end, end-of-life planning isn’t about dying. It’s about living well and leaving love behind. 💙

Introduction

Leaving a legacy means more than simply passing on possessions—it’s about sharing your values, memories, and life lessons with the people who matter most. Thoughtful end-of-life planning ensures your legacy continues to inspire and support your loved ones long after you’re gone. This post explores what it means to leave a legacy and offers practical steps to help you create one.

What Is a Legacy?

A legacy is the collection of values, stories, traditions, and tangible items you leave behind for future generations. It reflects who you are and what you stood for, and may include:

Personal Stories and Memories – Sharing life experiences and lessons learned.

Values and Beliefs – Imparting the principles and convictions that guided your life.

Family Traditions – Preserving meaningful practices, recipes, and rituals.

Life Advice and Guidance – Offering words of wisdom for the future.

Cherished Possessions – Passing down personal items and heirlooms with significance.

Philanthropy – Supporting causes that were meaningful to you through planned giving.

Steps to Creating Your Legacy

1. Document Your Life Story

- Write a memoir capturing your experiences, turning points, and personal reflections.

- Record videos or audio messages to communicate your thoughts, values, and guidance.

2. Preserve Family History

- Compile a family tree or genealogy to document your heritage.

- Create a photo album or scrapbook that includes captions and context behind the images.

3. Communicate Your Values

- Write personal letters to family members outlining your beliefs and hopes for their future.

- Share stories that highlight important life lessons and the principles you lived by.

4. Plan for Charitable Giving

- Establish a charitable fund or designate donations in your estate plan.

- Clearly outline your philanthropic intentions in your will or trust.

5. Distribute Meaningful Possessions

- Identify personal items and heirlooms you’d like to pass on.

- Include written notes explaining the importance of each item and why you’ve chosen specific recipients.

Benefits of Leaving a Legacy

Connection Across Generations – Your stories and values become a source of inspiration for future family members.

Preserved Memories – Important family history and personal insights are documented for generations to come.

Purpose and Fulfillment – Knowing your life has left a meaningful imprint provides comfort and satisfaction.

Reduced Conflict – Clear instructions and explanations can ease confusion and minimize disputes among heirs.

Best Practices for Sharing Your Legacy

- Use clear and simple language when writing instructions or messages.

- Keep your materials organized and up to date, especially memoirs, letters, and recordings.

- Store your legacy documents with your legal paperwork (such as your will or trust) to ensure they are easily found.

Conclusion

Creating a legacy is a meaningful part of end-of-life planning. By capturing your personal story, expressing your values, supporting causes you care about, and passing down treasured belongings, you ensure that your life continues to inspire and guide those you leave behind.

Your Digital Life Continues Without You: Managing Digital Assets

Your Digital Life Continues Without You: Managing Digital Assets

Introduction

In today’s digital age, our online presence and digital assets have become an integral part of our lives. However, many people overlook the importance of managing these assets as part of their end-of-life planning. So let’s discuss why it’s crucial to manage your digital life after death and provide tips for creating a digital estate plan.

Understanding Digital Assets

Digital assets include any online accounts, digital files, and online content you own. Examples of digital assets are:

- Social Media Accounts: Facebook, Instagram, Twitter, LinkedIn

- Email Accounts: Gmail, Yahoo, Outlook

- Financial Accounts: Online banking, investment accounts, PayPal, Venmo

- Subscriptions and Memberships: Netflix, Amazon Prime, professional memberships

- Digital Files: Photos, videos, documents stored on your computer, Google Drive, Drop Box

The Importance of Managing Digital Assets

Without a plan for your digital assets, your loved ones may face significant challenges in accessing and managing these accounts after your death. This can lead to:

- Loss of Important Information: Critical information and personal memories stored online may become inaccessible.

- Security Risks: Unmanaged accounts can be vulnerable to hacking and identity theft.

- Legal and Financial Complications: Failing to address digital assets can result in legal and financial complications for your estate.

Steps to Create a Digital Estate Plan

1. Inventory Your Digital Assets

- Make a comprehensive list of all your digital assets, including account usernames and passwords.

- Include any digital files stored on your computer, external drives, or cloud services.

Note: For assistance with this step click to download our Household Account Checklist>>

2. Designate a Digital Executor

- Choose a trusted person to manage your digital assets after your death. This person will be responsible for carrying out your digital estate plan.

- Ensure this person has the necessary information and access to your accounts.

3. Specify Your Wishes

- Clearly outline your wishes for each digital asset. For example, you may want certain accounts to be deleted, memorialized, or transferred to a loved one.

- Provide instructions for handling any sensitive or personal information.

4. Use Digital Estate Planning Tools

- Consider using digital estate planning tools or services that can help manage your online accounts and digital assets. (Such as My Life & Wishes and Password Management tools)

5. Include Digital Assets in Your Will

- While not all digital assets can be legally transferred through a will, it’s important to mention them and your digital executor in your will.

- Consult with an attorney to ensure your digital estate plan aligns with current laws and regulations.

Conclusion

Managing your digital assets is an important part of both everyday life and end-of-life planning. By putting a digital estate plan in place, you can make sure your online presence is handled the way you want—and give your loved ones the clarity and access they’ll need when it matters most.

In our next post of this series, we’ll discuss the psychological aspects of accepting mortality and how preparation can bring peace of mind!

Welcome back to Jon’s Introduction to Modern Death Etiquette series! Drawing from personal experience, Jon’s book, Click Here When I Die, offers practical guidance on navigating the complexities of end-of-life planning.

Welcome back to Jon’s Introduction to Modern Death Etiquette series! Drawing from personal experience, Jon’s book, Click Here When I Die, offers practical guidance on navigating the complexities of end-of-life planning.Understanding Family Dynamics

Every family has its own way of handling big discussions, and end-of-life planning is no exception. Here are some common challenges that may come up:

- Differing Opinions: Family members might have different views on medical care, finances, or funeral arrangements.

- Strong Emotions: Talking about death can bring up feelings of fear, sadness, or even denial, making discussions difficult.

- Communication Issues: Misunderstandings and lack of clear communication can lead to tension or confusion.

Strategies for Navigating Family Dynamics

1. Get Everyone Involved Early

- Bring all relevant family members into the conversation as soon as possible.

- Encourage open, honest discussions so that everyone feels heard.

2. Lead with Empathy and Understanding

- Acknowledge that this is an emotional topic and listen to your loved ones’ concerns.

- Try to see things from their perspective, even if you don’t fully agree.

3. Establish a Decision-Making Process

- Designate a key decision-maker, such as a healthcare proxy or executor of your will, to help avoid confusion later.

- Make sure everyone understands and respects this person’s role.

4. Set Clear Expectations

- Clearly explain your wishes and the reasoning behind them.

- Keep written documentation or let family members know how to access your recorded wishes to prevent misunderstandings.

The Benefits of Navigating Family Dynamics

By addressing potential conflicts early and planning proactively, you can:

- Ensure Your Wishes Are Honored: Clear, documented plans help make sure your choices are respected.

- Reduce Stress and Conflict: A well-thought-out approach can minimize disagreements and emotional strain on your loved ones.

Conclusion

Handling family dynamics is an important part of end-of-life planning. By including everyone early, setting clear expectations, and approaching discussions with empathy, you can create a more peaceful planning process—and ultimately make things easier for your family when the time comes.

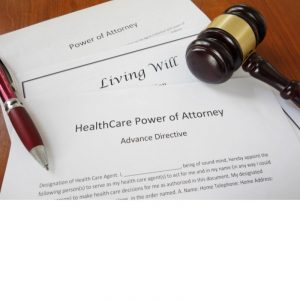

Essential Legal Documents for End-of-Life Planning (Without the Legal Jargon)

Essential Legal Documents for End-of-Life Planning (Without the Legal Jargon)

Welcome back to Jon’s Introduction to Modern Death Etiquette series! Drawing from personal experience, Jon’s book, Click Here When I Die, offers practical guidance on navigating the complexities of end-of-life planning. In this post, we’ll break down the key legal aspects you need to consider. Have you taken care of yours yet?

If you’re like most, talking about end-of-life planning might not be the most exciting topic, but it’s one of the most important things you can do for yourself and your loved ones. And it’s not just about having conversations—it’s about making sure your wishes are legally documented so they can actually be followed.

Here are the key legal documents you’ll need to consider having to make sure everything is in order:

1. Last Will and Testament

Your will is the big one. It spells out who gets what when you’re gone and can also name guardians for your kids if you have any. Without a will, the state decides how to divide your assets—and their plan might not match what you actually want.

2. Living Will (Advance Directive)

A living will allows you to clearly document your medical treatment preferences in case you’re ever unable to communicate. It covers crucial decisions like life support, resuscitation, and other critical care choices, ensuring your wishes are known and followed. As we’ve discussed in previous blogs, having this in place can prevent unnecessary stress and conflict among loved ones—giving them clarity instead of leaving them to debate what they think you’d want.

3. Durable Power of Attorney (POA)

This document allows someone you trust to handle your financial and legal matters if you’re unable to do so yourself. That includes paying bills, managing bank accounts, and making other financial decisions on your behalf.

4. Health Care Power of Attorney

Similar to a POA, but focused on medical decisions. This document lets you choose someone to make health care choices for you if you can’t make them yourself. Ideally, this person should understand your medical wishes and be ready to advocate for them.

5. Trust Documents

One of the biggest advantages of a trust is that it can help your family avoid probate—a lengthy, costly, and often stressful legal process that can delay access to your assets. Unlike a will, which must go through probate court, a properly structured trust allows assets to transfer directly to your beneficiaries according to your instructions.

Trusts are a powerful tool for managing your assets, allowing you to set specific terms for how and when your assets are to be distributed. They can be especially helpful in cases where you want to provide for minor children, individuals with special needs, or loved ones who may not be financially responsible.

Trusts also offer privacy since they don’t become public record like wills do. This means that the details of your estate and who inherits what remain confidential.

6. Beneficiary Designations

Don’t forget to check who you’ve listed as beneficiaries on things like life insurance policies, retirement accounts, and other financial assets. These designations override anything in your will, so reviewing them regularly is key.

Final Thoughts

This is just the core list—there are plenty of other legal documents that might be important depending on your situation, like Special Needs Trusts, Charitable Trusts, or even Pet Trusts.

The bottom line? Having these essential documents in place ensures your wishes are honored and makes things much easier for your loved ones. Take the time to meet with an estate planning professional and get everything sorted—it’s one of the best things you can do for yourself and your family.

And hey, if you missed any of the previous posts in this series, just scroll down to catch up! Stay informed and take control of your end-of-life planning!

Proactivity Over Procrastination: Take Control of Your End-of-Life Planning!

Proactivity Over Procrastination: Take Control of Your End-of-Life Planning!

Welcome to the next blog in the series of Jon’s introduction to Modern Death Etiquette! Based on personal experience, Jon’s book, “Click Here When I Die” aims to guide us through various aspects of end-of-life planning. Here we address something most of us do when it comes to End-Of-Life Planning – Procrastinate!

Let’s be real—procrastination happens to all of us, especially when it comes to topics like end-of-life planning. It’s not exactly something you’re eager to dive into over your morning coffee. But here’s the deal: putting in a little effort now can save your loved ones a world of stress and confusion later on.

In this post, we’re going to chat about why proactive planning is such a good idea and walk you through some simple steps to get started. Don’t worry—it’s not as overwhelming as it sounds.

Why Bother Planning Ahead?

Here’s the thing: getting ahead of this stuff isn’t just about ticking boxes—it’s about making life easier for you and the people you care about most.

You Call the Shots:

- Planning ahead means your wishes are clear and followed exactly how you want.

Less Stress for Your Loved Ones: Clear instructions take a huge load off your loved ones. They won’t have to play detective while trying to process and deal with their emotions. - Peace of Mind All Around: Once everything’s in order, you can breathe easier. And your family will feel the same way.

How to Get Started: A Friendly Step-by-Step Guide

Tackling this doesn’t have to be a huge project. Just take it one step at a time:

1. Figure Out Where You’re At

- Take a good look at your current situation—your health, finances, and personal wishes.

- Spot any gaps or areas you haven’t planned for yet.

2. Get the Legal Stuff Sorted

- Make sure you have the basics: a trust or will, power of attorney, and health care directives.

- If you’ve already done this, great! Just double-check that everything’s up-to-date.

3. Round Up Important Documents

- Gather key documents like insurance policies, property deeds, and financial account details.

- Stash the originals somewhere safe, and let someone trustworthy know where to find them. (Keep digital copies of documents for added protection and easy access.)

4. Don’t Forget Your Online Life

- List your digital accounts—think email, social media, on-line bills and accounts—and their passwords.

- You might even want to create a digital estate plan to manage these after you’re gone.

5. Talk About It

- This one can feel awkward, but it’s important. As we shared in the last blog in this series, share your plans and wishes with your loved ones. Or leave instructions about these things so they will know what to do and look for.

- Make sure they know where to find everything and how to handle things when the time comes. (The My Life & Wishes Legacy Vault™ is the perfect solution for this!)

6. Keep It Fresh

- Things change, and your plans should too. Make it a habit to review everything regularly and update as needed.

Wrapping Things Up

Here’s the bottom line: end-of-life planning might not be fun, but it’s one of the most thoughtful things you can do for yourself and the people you care about. By taking a little time now to get organized, you’ll make things so much easier for your loved ones and ensure your wishes are respected.

Take it one step at a time. You’ve got this!

Talk Isn’t Cheap: The Importance of End-of-Life Conversations

Talk Isn’t Cheap: The Importance of End-of-Life Conversations

Welcome to the next blog in the series of Jon’s introduction to Modern Death Etiquette! Based on personal experience, Jon’s book, “Click Here When I Die” aims to guide us through various aspects of end-of-life planning. This blog addresses the importance of having End-of-Life conversations!

Introduction

Discussing end-of-life wishes can feel daunting and, at times, uncomfortable. However, these conversations can hold profound value, offering clarity and a sense of peace for everyone involved. Openly sharing end-of-life preferences ensures that loved ones are on the same page, helping to prevent misunderstandings or potential conflicts during challenging times.

Engaging in these conversations isn’t just about healthcare choices or legal matters. It’s about building a roadmap that includes where to find important information when it’s needed most. This proactive approach provides loved ones with guidance and support, allowing them to focus on what truly matters when the time comes.

Starting the Conversation

Initiating a conversation about end-of-life planning can be challenging. Here are some tips to get started:

- Choose the Right Time: Find a quiet, comfortable setting where you won’t be interrupted. Consider bringing up the topic during a family gathering or a quiet moment with a loved one.

- Be Honest and Direct: Express your feelings and wishes clearly. Let your loved ones know why this conversation is important to you and how it can help ease their burden in the future.

- Use Resources: Utilize books, articles, or even this blog series as conversation starters. Sometimes, having a third-party resource can make the topic less intimidating.

Key Topics to Discuss

When you have the conversation, make sure to cover these essential topics:

- Health Care Wishes: Discuss your preferences for medical treatment, including resuscitation, life support, and organ donation.

- Legal Documents: Inform your loved ones about the location and contents of your Will or Trust, Power of Attorney, and other legal documents.

- Financial Matters: Share information about your financial accounts, insurance policies, and any outstanding debts. If you’re not comfortable sharing details, provide guidance on how to locate and access this information when needed.

- Digital Assets: Explain how to access your digital accounts and what should be done with them after your passing.

- Funeral and Burial Plans: Communicate your wishes for your funeral, burial, or cremation.

- Necessary Deeds and Other Documents: Provide access information, as important records such as deeds and tax returns will be a necessity.

The Benefits of Communication

Openly discussing your end-of-life wishes can bring unexpected gifts:

- Peace of Mind: Knowing that your wishes will be honored can provide a sense of peace for both you and your loved ones.

- Reduced Stress: Clear communication can ease the weight of uncertainty your loved ones might feel, helping them feel supported and prepared when the time comes.

- Strengthened Connections: Engaging in these conversations often bring families closer, creating a space for understanding, appreciation, and shared values.

Conclusion

Though it may feel challenging, sharing your end-of-life wishes is a thoughtful choice that gives loved ones the guidance they’ll need. Take the initiative to start the conversation and provide the peace of mind you and they deserve.

The Scavenger Hunt: Why You Need to Organize Your Important Documents Now!

The Scavenger Hunt: Why You Need to Organize Your Important Documents Now!

Welcome to the second blog in the series of Jon’s introduction to Modern Death Etiquette! Based on personal experience, Jon’s book, “Click Here When I Die” aims to guide us through various aspects of end-of-life planning. This blog addresses the importance of gathering your important documents now!

Introduction

Imagine your loved ones are left with the daunting task of sorting through your belongings to find crucial documents after your passing. Many of us would have trouble locating our own documents while living, so imagine how another person, with no guidance, would struggle to find things. This scenario, often referred to as “a looming scavenger hunt,” can be incredibly stressful and time-consuming. In this post, we’ll dive deeper into the importance of organizing your important documents now to spare your family unnecessary hardship and ensure that everything is in order when the time comes.

Why Organization Matters

Having your documents organized and easily accessible not only benefits us today, it is also one of the greatest gifts you can give your loved ones. When important documents are scattered or hidden, it can lead to delays in settling your affairs, increased legal costs, and emotional strain on those you care about.

Essential Documents Checklist

Here is a list of essential documents that you should gather and organize:

- Personal Identification:

- Birth certificate

- Social Security card

- Passport

- Driver’s license

- Legal Documents:

- Last will and testament

- Living will

- Power of attorney (financial and medical)

- Trust documents

- Financial Records:

- Bank statements

- Investment account statements

- Retirement account statements

- Tax returns (last three years)

- Mortgage documents

- Property deeds and titles

- Insurance Policies:

- Life insurance

- Health insurance

- Homeowners/renters insurance

- Auto insurance

- Medical Information:

- Health care directives

- Medical history

- List of medications

- Digital Assets:

- List of online accounts with usernames and passwords

- Digital estate plan

- Miscellaneous:

- Marriage certificate

- Divorce decree

- Military discharge papers (if applicable)

- Funeral and burial instructions

Tips for Storing Documents Securely

Once you have gathered all your important documents, it’s crucial to store them in a secure yet accessible location. Here are some tips:

Fireproof Safe: Keep originals of your most important documents in a fireproof safe at home or in a bank Safe Deposit box. Ensure that a trusted family member or friend knows the combination or where to find the key, or is authorized to access a box on your behalf.

Digital Copies: Scan and save digital copies of all your documents. Store them on a secure, encrypted cloud service or an external hard drive.

Document Organizer: Use a document organizer or binder with labeled sections for easy access. Keep this in a safe place and inform your loved ones where it is located.

Attorney or Financial Advisor: Provide copies of essential legal and financial documents to your attorney or financial advisor for safekeeping.

Communicate with Your Loved Ones

It’s not enough to simply organize your documents; you must also communicate with your loved ones about where these documents are stored and how to access them. Consider having a family meeting or writing a detailed letter to explain your organization system and any other important information they need to know.

Conclusion

Taking the time to organize your important documents is a crucial step in end-of-life planning. By doing so, you can significantly reduce the stress and burden on your loved ones during an already difficult time. Start today by gathering your documents, creating a secure storage system, and communicating with those you trust.

In our next post, we’ll delve into the importance of communication and how to have those challenging conversations about end-of-life planning with your family and friends. Stay tuned!

Embracing the Inevitable: An Introduction to Modern Death Etiquette

Embracing the Inevitable: An Introduction to Modern Death Etiquette

“Life does not cease to be funny when people die any more than it ceases to be serious when people laugh.” – George Bernard Shaw

Introduction

Death is an inevitable part of life, yet it’s a topic many of us shy away from discussing. In our digital age, thoughtful end-of-life planning is more crucial than ever. Inspired by personal experiences, my book “Click Here When I Die” aims to guide you through modern death etiquette, simplifying the process for your loved ones when the time comes.

In this blog series, I’ll highlight some of the main points outlined in the book to provide you with practical advice and insights. From organizing critical documents to managing your digital footprint, we’ll cover the essentials of creating a comprehensive end-of-life plan. You’ll learn how to communicate your wishes effectively, ensuring that your intentions are understood and respected. Additionally, we’ll delve into the emotional aspects of preparation, helping you and your loved ones navigate this challenging journey with compassion and understanding. By sharing these key takeaways, I hope to empower you to embrace this often-overlooked aspect of life, making it easier for those you care about to handle your affairs when the time comes.

The Importance of Preparation

For centuries, death has been a taboo topic. However, avoiding conversations about it can lead to unnecessary stress and confusion for those we leave behind. There are many aspects to consider when preparing for the inevitable, from important documents to digital accounts. Taking the time to organize these elements can significantly ease the burden on your loved ones.

The Goal of This Series

The following topics will address various aspects of end-of-life planning, from organizing important documents to managing your digital legacy. By the end of this series, you will have a comprehensive understanding of what it takes to ensure your loved ones can rest easy, knowing everything is taken care of;

- The Scavenger Hunt: Finding Important Documents

- The Importance of Communication

- Proactivity Over Procrastination

- Legal Aspects: Making It Legal

- Family Dynamics and Planning

- Your Digital Life After Death

- Facing Mortality: Acceptance and Preparation

- Final Thoughts: Leaving a Legacy

- Resources for End-of-Life Planning

By the end of this series, you’ll have a comprehensive guide to modern death etiquette, helping you prepare for the inevitable with grace and thoughtfulness. Embracing this conversation can bring peace of mind to you and your loved ones, ensuring that everything is taken care of when the time comes!

Stay tuned for our upcoming posts, where we’ll dive deeper into each topic.

Revolutionizing Estate Planning for a Seamless Legacy

Revolutionizing Estate Planning for a Seamless Legacy

Creating a comprehensive estate plan involves more than drafting important legal documents. It’s about;

- Safeguarding your client’s legacy

- Ensuring their loved ones have the support they need during challenging times

- Empowering you “estate planning attorneys” to provide unparalleled service

Enter The Legacy Vault by My Life & Wishes, the trusted, secure, and digital legacy planning and storage solution designed to be “The Missing Piece To A Complete Estate Plan”!

Solving a Pressing Issue:

The aftermath of a loved one’s passing can be overwhelming, burdening families with;

- stress

- frustration

- time constraints

- unnecessary financial expenses

The Legacy Vault addresses these challenges head-on by offering a seamless platform that grants instant access to;

- online account

- digital identities

- essential information and directives

- critical documents

This streamlines the process of settling final affairs, providing much-needed relief to grieving families.

Empowering Estate Planning Attorneys

The Legacy Vault doesn’t just benefit individuals; it revolutionizes the way estate planning attorneys serve their clients. Acting as a game-changing differentiator, this platform sparks profound and meaningful conversations, ultimately boosting client retention and driving an influx of referrals.

Many forward-thinking firms seamlessly integrate The Legacy Vault into their Client Care Membership Plans, ensuring a reliable stream of recurring revenue.

Exclusive Legacy Vault Highlights:

· Prioritizing your Client’s Family

· Ensuring your Client’s Peace of Mind

· Elevating the Importance of your Client’s Estate Plan

· Preserving your Client’s Legacy

Three Compelling Reasons Estate Planning Attorneys Choose The Legacy Vault:

· Operational Efficiency

· Strategic Differentiation

· Financial Benefits

In Summary:

The Legacy Vault by My Life & Wishes is more than just a digital platform; it’s a transformative tool that empowers individuals, eases the burden on families, and enhances the services provided by their estate planning attorney.

By prioritizing family, ensuring peace of mind, elevating the importance of estate plans, and preserving legacies, this platform becomes an integral part of shaping a legacy that lasts for generations.

Embrace the future of estate planning with The Legacy Vault and unlock “The Missing Piece To A Complete Estate Plan”!

6 Key Attributes to look for in an Estate Planning Attorney

6 Key Attributes to look for in an Estate Planning Attorney

The estate planning process includes some of the most important decisions you’ll ever make. Such as;

What will happen to your money when you die;

Who will look after your kids if you die while they’re still minors; and

What kind of legacy you’ll leave behind.

These decisions are too important to leave to chance! That’s where an estate planning law firm can help. They’ll guide you through wise and well thought out decision-making.

As you search for the right estate planning attorney, there are key qualities that you should consider.

1. Knowledgeable

Estate Planning is a complex task. The attorney you choose should demonstrate the following:

They know the proper way to handle these plans.

They are up to date on regional estate laws, probate laws, Medicaid laws, and tax laws.

They focus their practice on probate, trust, living wills, probate avoidance, medical asset protection, estate tax planning, and healthcare proxy.

To be sure that your attorney is up to the task, be sure that they focus their practice exclusively on every aspect of estate planning.

2. Fee Structure

Flat-fee pricing will keep costs predictable and prevent financial surprises further down the road. Also make sure you understand what is covered in your flat fee, and that it meets all of your needs.

3. Various Planning Options

Your needs may be simple or very complex. Your attorney should be able to handle it all. From will creation, trust establishment, estate tax minimization, avoiding probate and more.

4. Compassionate

You’re going to be sharing some very personal information with whoever you hire to draft your estate plan. Make sure your attorney is someone you feel comfortable with. Signs of a compassionate estate planning attorney include;

clarity in explaining the process,

shows empathy, and

speaks to you in layperson’s terms so you can understand the documents, decisions and process.

5. Cares about your estate plan today…and tomorrow

It’s not a set it and forget it transaction! Life circumstances change, and estate plans need to be updated. Your attorney should offer a maintenance plan or otherwise stay in touch to update you when your plan needs review.

6. Professional Memberships and Groups

Continued education and staying current is essential. See what professional organizations your attorney is a member of, such as; Personal Family Lawyer, WealthCounsel, and ElderCounsel. From these organizations’ websites, you can search for the best estate planning attorneys in your area.

7 Reasons Why You Should Make or Update Your Will

7 Reasons Why You Should Make or Update Your Will

Wills are one of those things in life that everyone knows they need, yet somehow seem to procrastinate when it comes to getting it done.

When you make your Will, you’re giving your family and loved ones a gift. Your Will ensures that your loved ones can grieve in peace rather than wonder what to do, or worse – argue, litigate, or resent each other over the details of your estate after you’re gone.

Here’s the top 7 reasons to have a Will:

1. You decide who will take care of your minor children.

Name the right legal guardians for your children if you and your spouse can’t be there. If you have minor children, and no Will, a judge will decide who cares for them, and the situation may not be ideal.

2. You control how your property and assets will be distributed.

Dying without a Will means you’ll have no say over who receives your property. State laws will decide. In some states, only 1/2 of one’s assets go to the surviving spouse. Depending on your situation, the rest would go to your children, parents or close relatives. You’ve worked hard to build your estate, be sure you get to decide who it goes to…not the courts!

3. You assign an executor to make sure that your wishes are carried out and that your affairs are in order.

An executor is the person appointed in the Will to manage the estate, deal with the probate court, pay outstanding debts, collect assets, and distribute the estate according to the provisions of the Will. Choosing the right person to carry out your final wishes is essential. Consider who can file paperwork on time and handle potentially volatile family relationships. Here are some recommendations that may help when choosing your executor: https://www.legalzoom.com/articles/how-to-choose-an-executor

4. Allows you to alleviate potential arguments and legal challenges for your loved ones. The biggest cause of family infighting after a loved one passes seems to be from unclear Wills, or a complete lack of a Will at all. Everyone has different ideas on what they think you might have wanted. Having a Will lays it all out, alleviating family guessing and turmoil.

5. Saves loved ones a lengthy probate process.

The last thing family and friends want is to have estate matters drawn out for months (or years) after someone dies. Knowing what probate actually involves will help ease fears about the process—one that isn’t always as complex as you might think. Read more at: https://www.legalzoom.com/articles/the-top-three-ways-to-avoid-probate?li_source=LI&li_medium=AC_side

6. Minimize estate taxes so more value passes on to your loved ones.

Let’s face it, none of us enjoy paying taxes. So even worse, after your death, your estate may be subject to several kinds of taxes. Some states have an inheritance tax and/or an estate tax. The federal government imposes an estate tax that applies no matter where you live. (If your estate is worth less than a certain amount, no estate taxes will be due.) Getting advice from an estate planning or tax attorney or will help you better understand and plan for your situation.

7. Because tomorrow is not promised.

Focus on more than just the health and happiness of your family today. Put plans into action that protect your family long into the future.

If you want to protect your family into the future and get started on YOUR Will, click here to read more… https://www.mylifeandwishes.com/end-of-life-planning/wills/

Choosing a Beneficiary

Choosing a Beneficiary

One of the most crucial steps in life insurance planning is choosing your beneficiary, which is the person (or entity) that will receive the cash benefits upon your death. These guidelines may help ensure that you are leaving the benefits to those you intended.

Who or what can be a beneficiary?

- Persons – generally you can name anyone with whom you have a relationship such as family members, friends, or loved ones

- A trust

- A charity

- Your estate

How many beneficiaries should typically be named?

Beneficiaries are typically categorized as primary and secondary (or contingent) beneficiaries.

The primary beneficiary is entitled to the proceeds of the policy upon the death of the insured. A secondary (or contingent) beneficiary is entitled to the policy proceeds if the primary beneficiary has predeceased the insured. In some cases, a final beneficiary is named in the event both the primary and secondary beneficiaries have passed prior to the insured.

What are some of the more common mistakes when naming a beneficiary?

Naming a minor child. Most life insurance companies will not pay proceeds directly to minors. If you have not created a trust, you may want to designate a custodian under the Uniform Transfers to Minors Act (UTMA) to act on behalf of the minor.

Overlooking your spouse in a community property state. If you live in a community property state your spouse may be entitled to a portion of any life insurance proceeds due to its marital property laws. If your desire is to leave proceeds to someone other than your spouse, then the spouse may need to sign a marital property waiver, and include it with the beneficiary form.

Making a dependent ineligible for government benefits. Naming a dependent, such as a child with special needs, puts that dependent at risk of losing governmental assistance, if they are receiving some. Anyone receiving a gift or inheritance of more than $2,000 may be disqualified from Social Security Income and Medicaid.

Assuming your last will and testament trumps the policy. A life insurance policy is a contract. And regardless of what your will says, the insurance company must pay the beneficiary listed on the policy. This is easily fixed by updating your policy to pay according to your will.

Forgetting to update. Remember to update your beneficiaries after major life events, such as marriage, having children, or divorce. Change your beneficiaries when your circumstances change!

Naming only a primary beneficiary (or none at all). When there is no living beneficiary, or none named, the life insurance benefit typically goes into the estate and becomes subject to probate. This leads to heirs facing a long wait to get the money, and the proceeds would then be available to pay off creditors.

Staying mum. Tell someone that you have life insurance, where it is, and how to find it! In the United States alone there is over $1 billion dollars in unclaimed life insurance benefits.

Beneficiaries are named in retirement accounts and in life insurance. Take the time to review your retirement plan and your life insurance policy to make sure your beneficiary information is designated appropriately and serves the purpose you intended.